NVIDIA - Stock Coverage Part I (Indusry)

29 Marzo 2021

Gustavo Mota

The following analysis is intended as starting coverage NVIDIA Corp, "the company" by one or various members of Indexy's research team, "the analysts". This report does not constitute a direct particular investment recommendation, the positions taken on the stock must be done under the frame of a whole portfolio analysis.

The company does not pay or reward in any matter the analysts covering and publishing this report. Indexy provides services of portfolio management and investment advisory. Indexy's client portfolios or recommendations own or include shares of the company's securities. The analysts own shares of the company's securities.

Stock markets returns are volatile and therefore, investments in stock markets may loose value. For any question or concern please write to: gustavo@indexy.mx and research@indexy.mx

Motivation

The reason for integrating the company as part of our special research coverage is because we believe that the company is standing at the edge of innovation and the whole industry is worth reporting since, not only this one, but many of the companies mentioned are considered to create value for today and for the foreseable future. The following points summarize what draw our attention:

- Talks were held with crypto-mining and gaming experts assuring that the company is among the most competitive in Tech industry from a customer's perspective, due to its high loyal client base and market leadership in GPU products

- Analysts in the global markets have been marking the stock as a BUY for at least 2 - 3 years

- It is one of the biggest names in our high-end specialized tech products (laptops, workstations, desktop PCs, videogames)

- To prove the thesis of overpricing as per some headlines in the financial news (thesis to be supported or rejected by data)

Introduction

With this piece of analysis we intend to start a full coverage on NVIDIA Corp and therefore one or more of its related securities. Namely, the common/ordinary shares outstanding, debt securities outstanding and derivatives contracts such as call options for expiration within the next year or the following 3 years.

Though we do not like to follow what we feel as already burnt-out opportunities, considering that double-digit growth over decades is something we rarely see in financial markets, we do think that NVIDIA represents one of this lifetime opportunities, as the company has been in the edge of the growing technologies and in recent years has been incorporating into its project portfolio some of the outmost future megatrends.

NVIDIA has not only evolved into its own industry by taking leadership in providing very specific specialized components with high differentiation, but also over the past years, the company has been acquiring businesses and adding forces into the industries that in our opinion will be the most important in the future. Any investor considering gaining exposure to Artificial Intelligence (AI), Cloud Computing, Internet of Things (IoT), while maintaining a big stake of exposure in some of today's most significant sub-markets in Tech consumption, should own this share.

Source: Unsplash. "RTX (Ray Tracing) Graphic Processing Unit"

Industry analysis and Macro Moves

The Tech sector

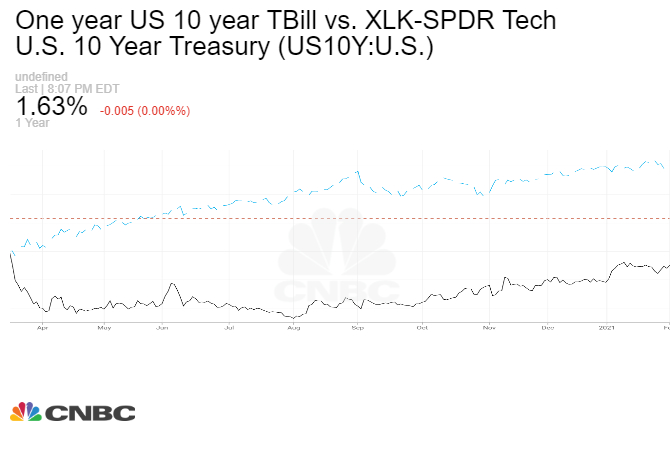

NVIDIA is broadly categorized under the Technology sector. Recently tech stocks suffered a sold off due to raise on long term bond yields due to high expectations on inflations, therefore affecting the price valuations of companies specially those relying strongly on weighted growth revenues in the future.

Source: CNBC Charts

Still, tech industry is being rated today with an overweight mainly because the effects of the 2020 pandemic in lifestyle pulled out of nearly any consumer the need for connectivity, remote work, cloud systems enhancements, etc. The world we used to know before COVID-19 will never be the same and we are sure that the pandemic was just one of the firsts catalysts for this transformation to happen.

The Semiconductor industry

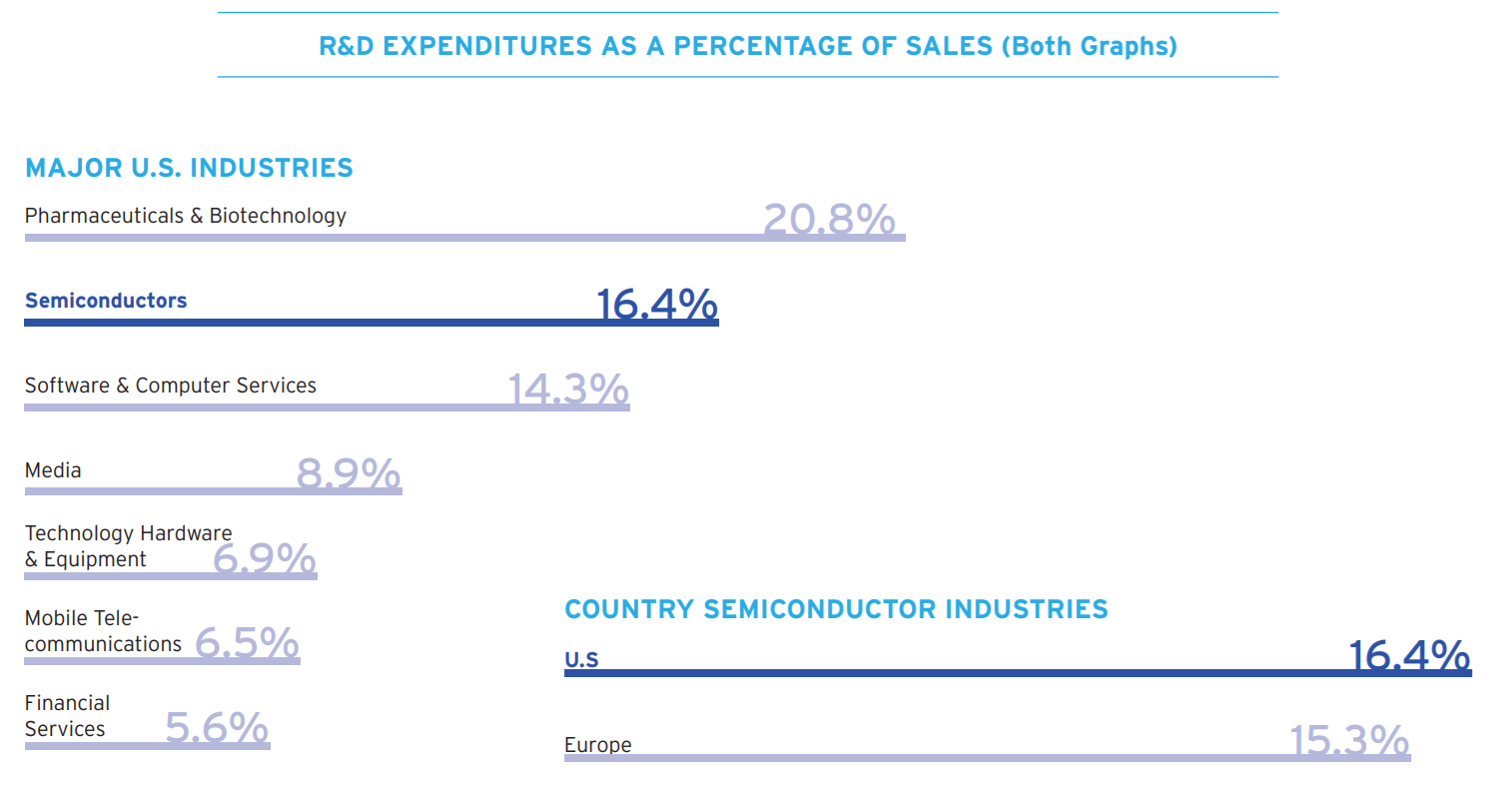

On a more specific basis, NVIDIA is catalogued under the Semiconductor industry, according the the Semiconductor Industry Association's (SIA) 2020 Factsheet, the US semiconductor industry is "the worldwide industry leader" accounting for 50% of the global market share, and semiconductors are within the top-5 U.S. exports, being 80% of the produced items consumed overseas. One of the key metrics that will be considered later in this report and in future reports is related to the costs of R&D in the industry overall and specifically in the GPU and other microchips research. As per the factsheet, the industry invests about 1/5 of its revenue in R&D, this makes a straightforward definition of our company in subject to be considered as a growth company.

Source: SIA. 2020 State of the Industry Report

The industry is considered by our research team to be in a mid to late growth stage with high barriers of entry, highly competitive oligopoly dynamics, strong capital insensitivity and with a high pricing power due to its differentiated products. Also is worth noting that as manufacturing, semiconductor industry is cyclical.

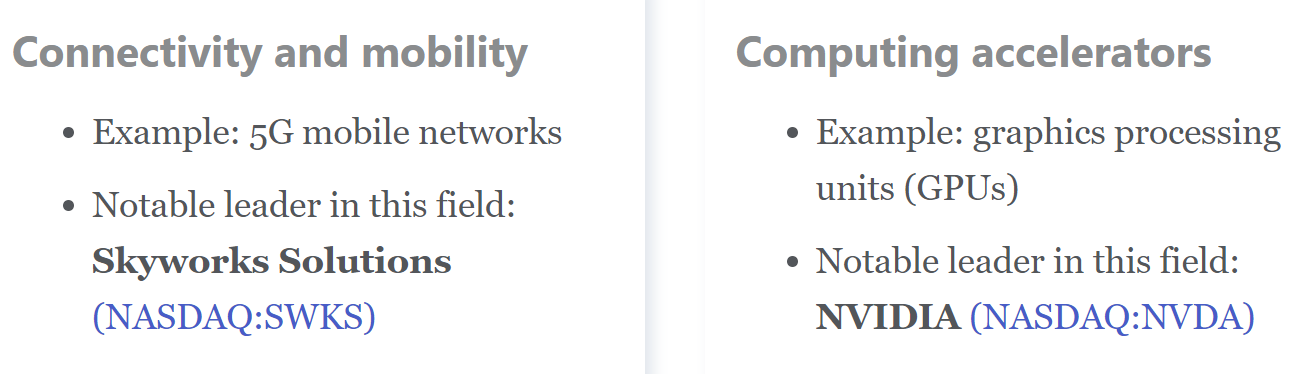

As mentioned in the Motley's Fool's report, the growth trends for semiconductor industries are described below:

Source: The Motley Fool. Investing in Semiconductor Stocks: Jan 5, 2021

https://www.fool.com/investing/stock-market/market-sectors/information-technology/semiconductor-stocks/

NVIDIA's competitive position and segments

NVIDIA ended the year with 82% of the discrete GPU market under its control, up from 73% in the year-ago period according to the 4Q GPU market report, up 2% from the previous quarter and almost 10% up in a YoY basis.

NVIDIA pioneered and consolidated as a leader in the Graphic Processing Unit industry. Today is the top-of-mind brand for gamers, whose immersive experiences have been growing and developing along with the capabilities and innovations of the GPU maker. Furthermore, the gaming GPU is expanding as a result of the increasing population of live streamers, broadcasters, artists and creators. With the release of their RTX (Ray Tracing technology) GPU's, the company expects to re-engage and to broaden its market share, maintaining the role of the pioneer, most disruptive and advanced participant in the highly dynamic field of graphics and video processing.

Source: Unsplash. Gaming Desktop

In the scientific and research market, NVIDIA also enjoys a bold position since their GPU's support most High-performance Computing (HCI) applications in some of the most demanding fields such as aerospace, bio-science, biotech, fluid simulations and energy exploration. Not to mention that GPU's are suited as well for AI, deep learning and machine learning applications. We went through the ranked list of the top 500 super computers as of November 2020 and parsed the database to find in which proportion NVIDIA components are present.

At least 142 out of 500 use directly NVIDIA's products distributed mostly within the top one hundred, in which the company has a participation of around 70%

The segments and markets

NVIDIA reports it's results in two segments:

-

The Graphic Segment

Includes GeForce GPUs for all gaming and PCs, the GeForce NOW game streaming service, infrastructure and solutions for gaming. Also, the GPUs for enterprise virtual workstation graphics such as Quadro and RTX and the platforms for visual computing

-

The Compute & Networking Segment

The segment includes the data center platforms and systems for AI, HPC and accelerating computing, as well as the development agreements for the automotive AI Cockpit, as well as the Mellanox networking and interconnect solutions

The markets that NVIDIA cover can be classified, as per the company's 10K reports into:

- Gaming

- Professional Visualization

- Data Center

- Automotive

Throughout these markets the company delivers processors, interconnects, software, algorithms, systems and services, providing a unique value, expertise and degree of specialization unique in the market.

What's the NVIDIA's peer group?

NVIDIA is classified under semiconductor industry, we ran a stock screening under that specific industry as per the GICS ® Classification and over a comparable market size. The result yields initially the biggest 20 global semiconductor firms measured by Market Cap, being NVIDIA the second only below Taiwan Semiconductor Manufacturing Company (TSM) and above Intel Corporation.

I the broader sense we can use the semiconductor industry index, based on the classification mentioned above, weighted by market cap as a rough gauge for the industry and therefore, a simplistic generalization for the company in terms of business cycles, trends and growth as the industry overall

However, in a most specific way, to make multiple comparables we may select some companies considered as competence and peers in the same industry, providing similar products and technologies or delivering services to the same markets. We start by selecting companies in the same industry and excluding those such as TMS that are indeed vendors and not competitors, and are rather connected in the supply chain than along the competition field.

After this filter is applied, we scan through the 10K and 10Q fillings of the company and identify specific competitors, which mostly are in the same industry group. There are others however, whose core businesses are outside the specific semiconductor design or fabrication industry but engage in very similar activities.

Based on the criteria above, we came with the following peergroup

- Intel Corporation

- AMD

- Broadcom Inc

- Ambarella Inc

- Qualcomm Inc

- Xilinx Inc

- Renesas Electronic Corporation

- Samsung

- Applied Optoelectrics

- Marvell Technology

- HP

- Juniper Networks

- Lumentum Holdings

- Arista Networks

- Cisco Systems

Más notas